Are you a Nigerian student seeking financial aid for your education? The Federal Government of Nigeria student loan has been made available via the Nigerian Education Loan Fund, better known as NELfund. This well-needed initiative provides students with access to interest-free loans to help support their education.

- Who can apply for the NELfund student loan?

- NELfund application procedure

- Step 2: Profile creation

- Step 3: NELfund loan application

- In conclusion

- Frequently asked questions(FAQs)

- How much is a NELfund student loan?

- How long does it take for NELFUND to approve a student loan?

- What is the meaning of NELfund in Nigeria?

- How to track NELfund loan?

- Can a direct entry student apply for the Nelfund loan?

- Is there any interest payable on the Nelfund loan?

- Who administers the NELfund loans to students?

- Who is eligible to apply for the NELfund loans?

- Is there an age limit for NELFUND applications?

- When is the Nelfund loan due for repayment?

In this guide, we will walk you through the step-by-step process of how to apply for the NELfund Nigeria student loan. We will provide you with the eligibility criteria as well as the documents needed in your application.

Kick back, relax, and follow this comprehensive guide!

Who can apply for the NELfund student loan?

Before we give you a step-by-step guide on how to apply for the Nelfund student loan, lets see if you meet the following NELfund eligibility requirements below:

- You must hold a Nigerian citizenship to be considered for this student loan.

- Students admitted to any public Nigerian university, polytechnic, college of education, or vocational school, with proof of admission including Name, Date of Birth, Admission, JAMB number, Matriculation number, and BVN, are eligible to apply. Both new and current students can apply for the loan.

- NELfund is available to all public tertiary institutions, with the first phase limited to students in federal institutions in Nigeria. Future phases will be announced later on.

- You must also insure that your data has been uploaded by your institution to the NELfund portal or else you will not be able to apply.

NELfund application procedure

Prior to starting the application for the NELfund loan, insure that you have the following details ready below:

- Name of Institution of study

- Admission Number

- JAMB Number

- Date of Birth

- NIN

- BVN

Now that we have that covered, Let’s get started!

Step 1: Account setup

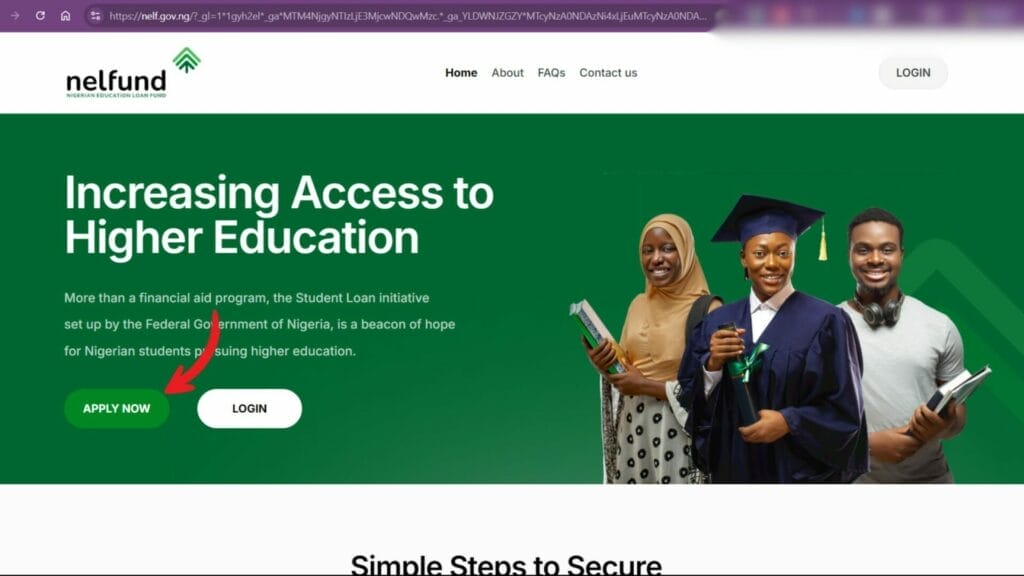

- Navigate to the official NELfund website and click the “Apply Now” button. Follow the “Get Started” button and start the account creation process.

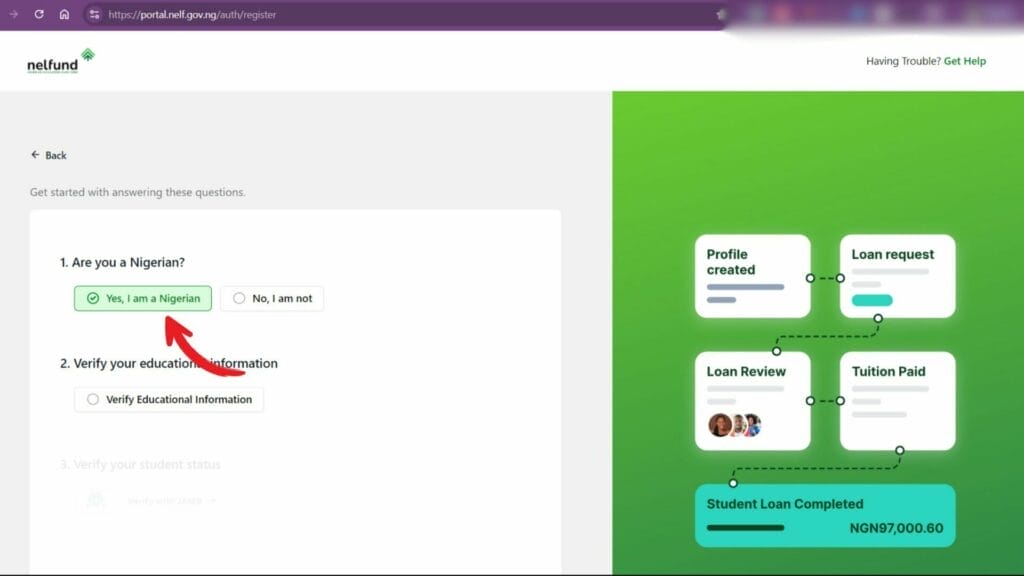

- Select the “Yes” option when asked if you are a Nigerian. The “No” option will end the entire sign up process—The loan is only available to Nigerians.

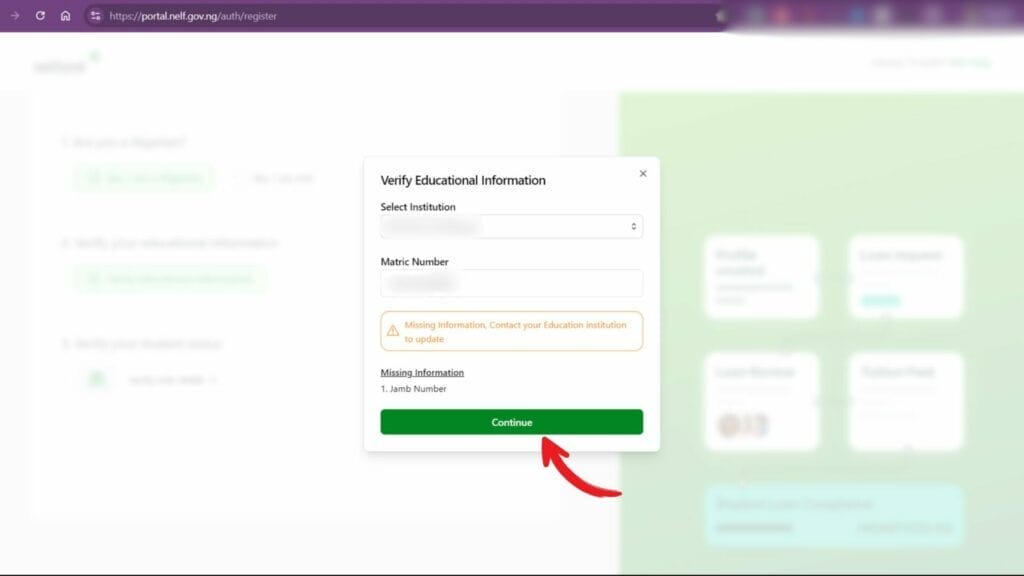

- Verify your educational information by selecting your institution and typing in your matric number.

- If your institution has added your data to nelfund, you will get a continue option. If not, you cannot proceed further until your institution uploads your details.

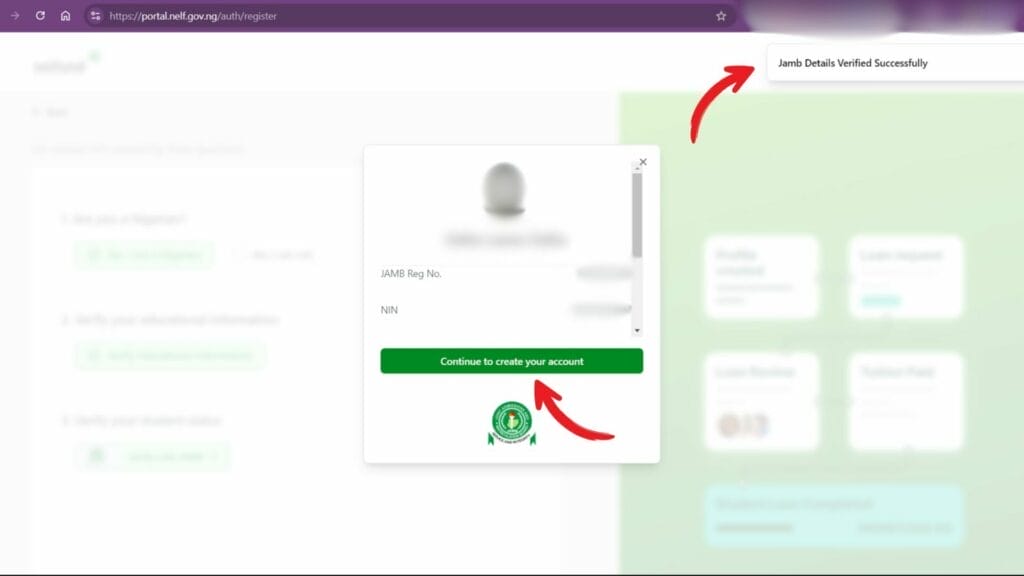

- You will then verify your student status via JAMB. Enter your JAMB registration No and date of birth that corresponds with your institutions records, then click “Verify JAMB Profile”

- You should get a prompt saying “JAMB details verified successfully” with your JAMB details to confirm. You can now continue to creating an account.

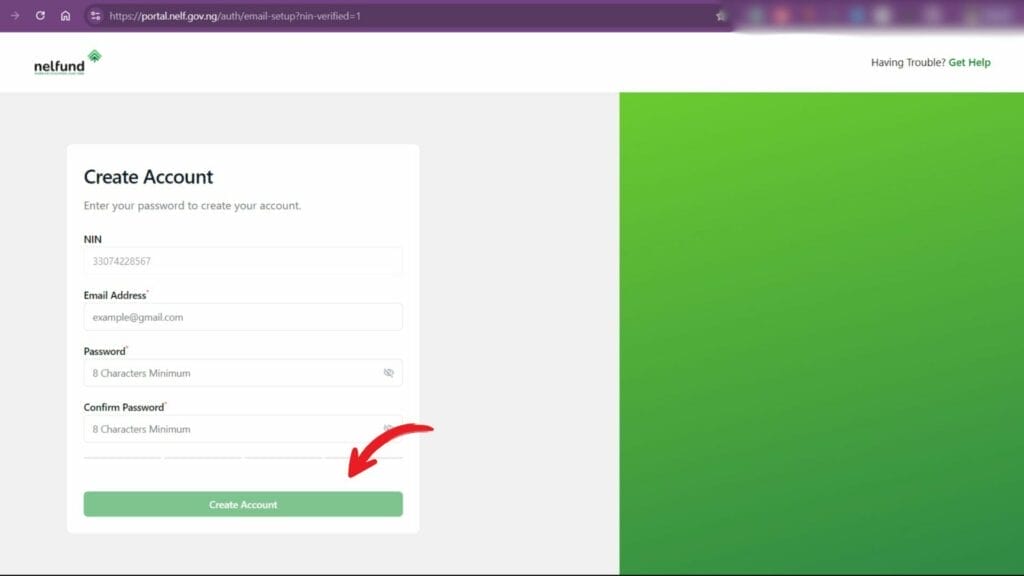

- Input your NIN, valid email address, and password in the corresponding spaces available. Click “Create Account”

- After creating your account, you will be required to verify your email through the link sent to the respective email.

- Congratulations! You have now created an account with NELfund.

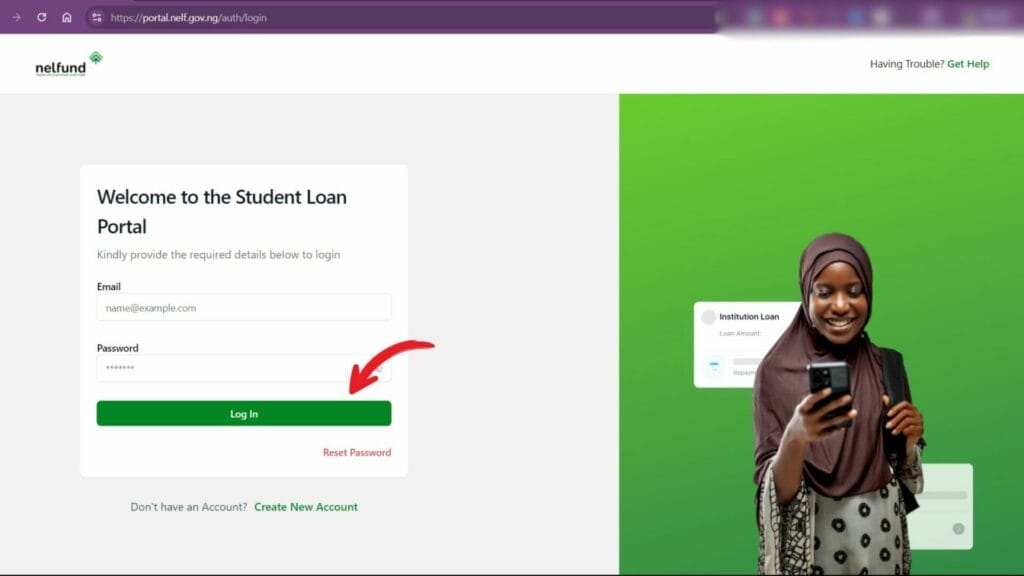

- Proceed to the login page and enter your email and password to login.

Step 2: Profile creation

- Now that you’re in your account, let’s fill out your personal details.

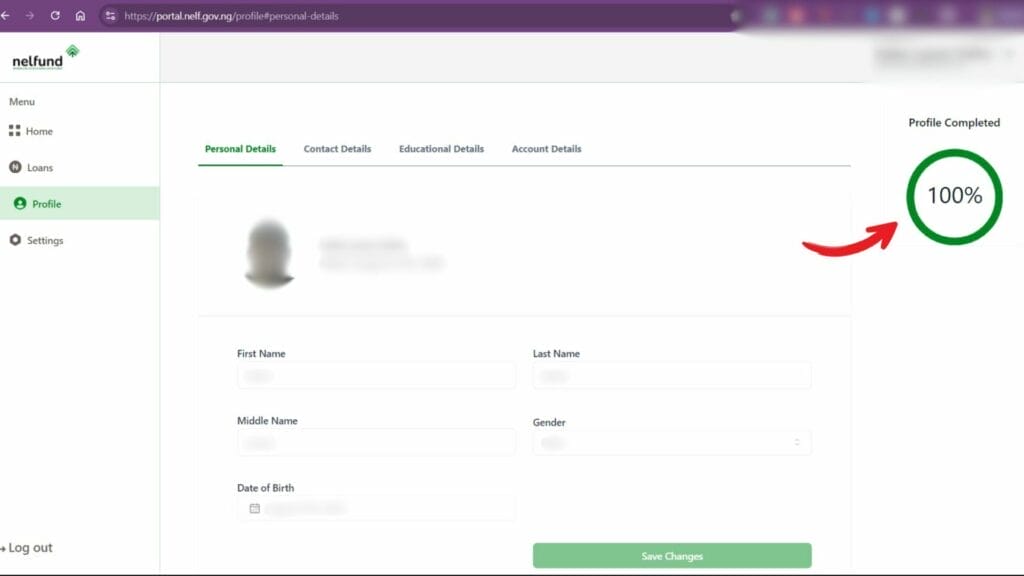

- Navigate to the “Profile” menu on the top right corner of your screen—for mobile users—or the left hand side of your screen—for desktop users. Click “Profile”

- Navigate to the “Personal Details”, “Constant Details”, “Educational Details”, and “Account Details” section each.

- Fill in your details in the corresponding spaces available.

- After completing your profile, you should get Profile completion score of “100”.

- Congratulations on completing your profile, you can now proceed to applying for the loan.

Step 3: NELfund loan application

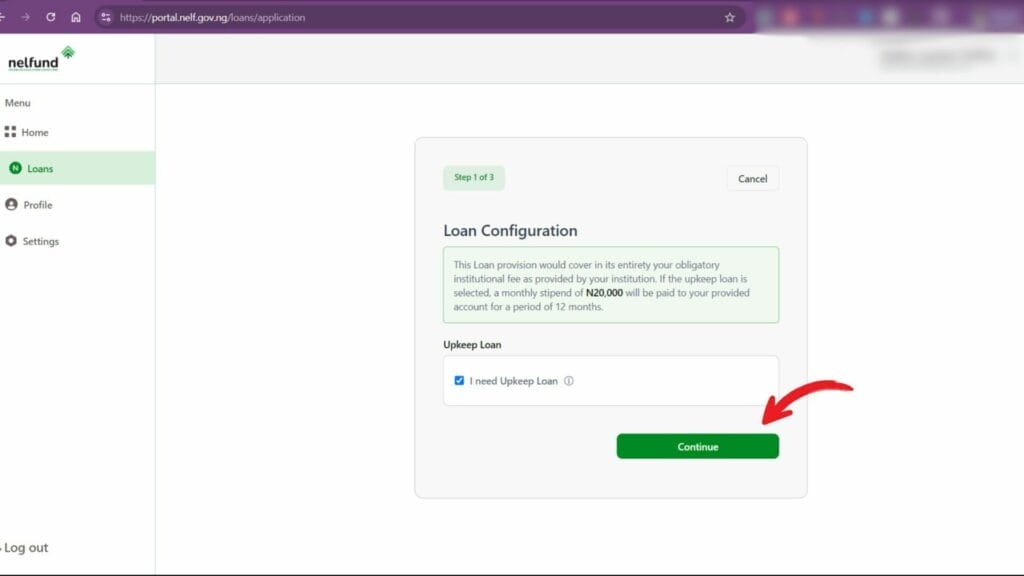

- Just like how you went to the “Profile” menu in the previous step, navigate to the “Loans” menu to start your NELfund loan application.

- You will then me prompted with a 3 step process to Apply for the loan.

- The 1st step will provide you with the option to select whether you want an upkeep loan of 20k paid monthly in addition to your tuition fee loan.

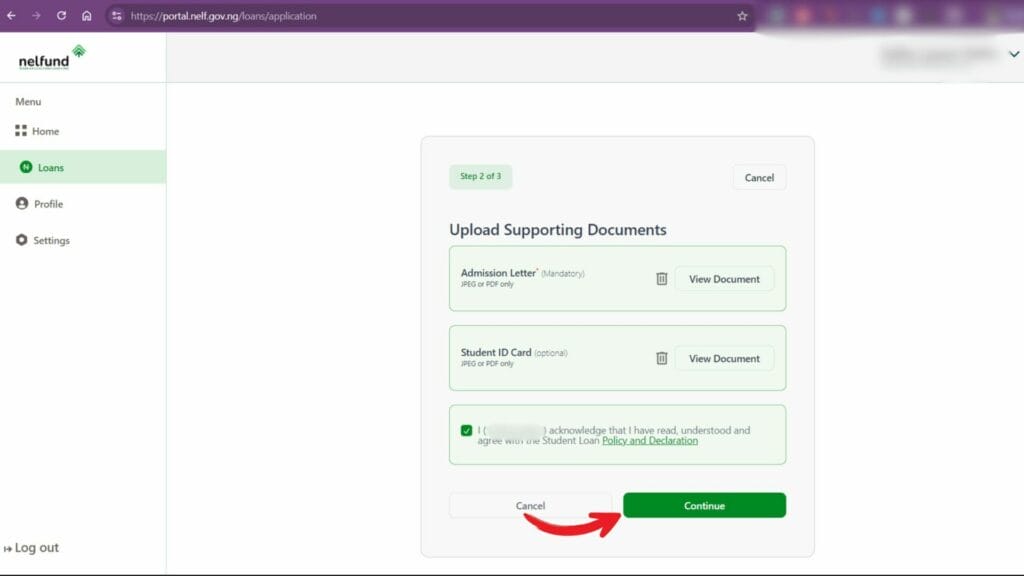

- The 2nd step will provide you with spaces to upload your University admission letter as well as your student ID card (which is optional). Check the acknowledgement box to proceed. Note that uploading the documents are necessary before continuation.

- The 3rd step is just a confirmation to apply for the loan.

- And that’s all folks, you have now successfully applied to the NELfund loan.

In conclusion

If you have followed the steps above thoroughly, you should have been able to apply for the NELfund student loans seamlessly. We understand that even though we have gone through all of the steps, people might still have questions pertaining to the application process or other enquiries. So look through our compiled list of frequently asked questions below. If you still have questions not answered, feel free to contact us.

Frequently asked questions(FAQs)

How much is a NELfund student loan?

The NELfund student loan is dependent on institution and course of study, but it will pay the full tuition cost of any approved student as well as a 20k upkeep if selected in the application procedure.

How long does it take for NELFUND to approve a student loan?

It can take anywhere from a few weeks to months for NELFUND to approve a student loan, all depending on time of application and institution. NELFUND will disburse funds within 30 days of approval of successful applications.

What is the meaning of NELfund in Nigeria?

NELFUND stands for the Nigerian Education Loan Fund. They were established by the Federal Government of Nigeria via the Student’s Loan Act for the goal of providing Nigerian students access to zero interest loans to enable them to pay for institution fees and upkeep to any higher institution of their choice within Nigeria.

How to track NELfund loan?

You can tract your NELFUND loan via your application portable on the official NELfund website.

Can a direct entry student apply for the Nelfund loan?

Yes, a direct entry student can apply for the NELfund loan as long as they have a JAMB Number.

Is there any interest payable on the Nelfund loan?

No, there is zero interest payable on the NELfund loan.

Who administers the NELfund loans to students?

The loan will be administered by NELFUND themselves.

Who is eligible to apply for the NELfund loans?

The people eligible to apply for the NELfund loan are students who have secured admission into all public Nigerian universities, polytechnic, colleges of education, vocational schools, with proof of admission that includes Name, Date of Birth, Admission, JAMB Number, Matriculation number, and BVN. All new and existing students within the institution above can apply for the loan.

Is there an age limit for NELFUND applications?

No, Nelfund applications has no age limit.

When is the Nelfund loan due for repayment?

The NELfund loan is due for repayment 2 years after the completion of NYSC. If the applicant does not have a job after 2 years, they should notify Nelfund via sworn court affidavit every 3 months after two years post NYSC.